Loanato - Corporate Module

Harun Grabus

Software Engineer Team Lead

7 min read

Published

27th July 2023

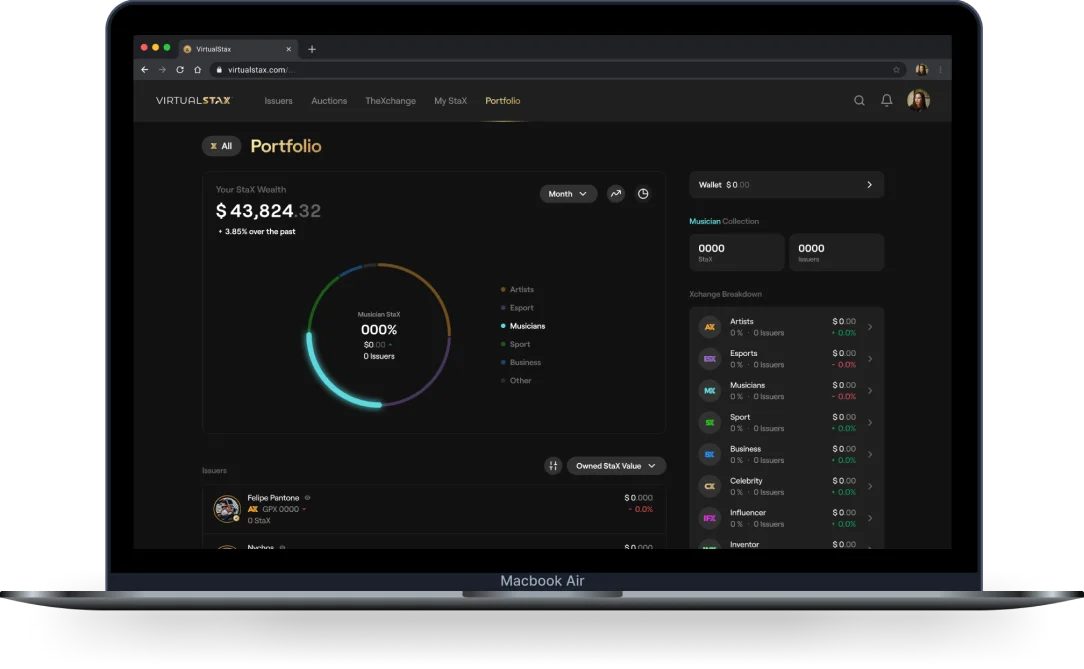

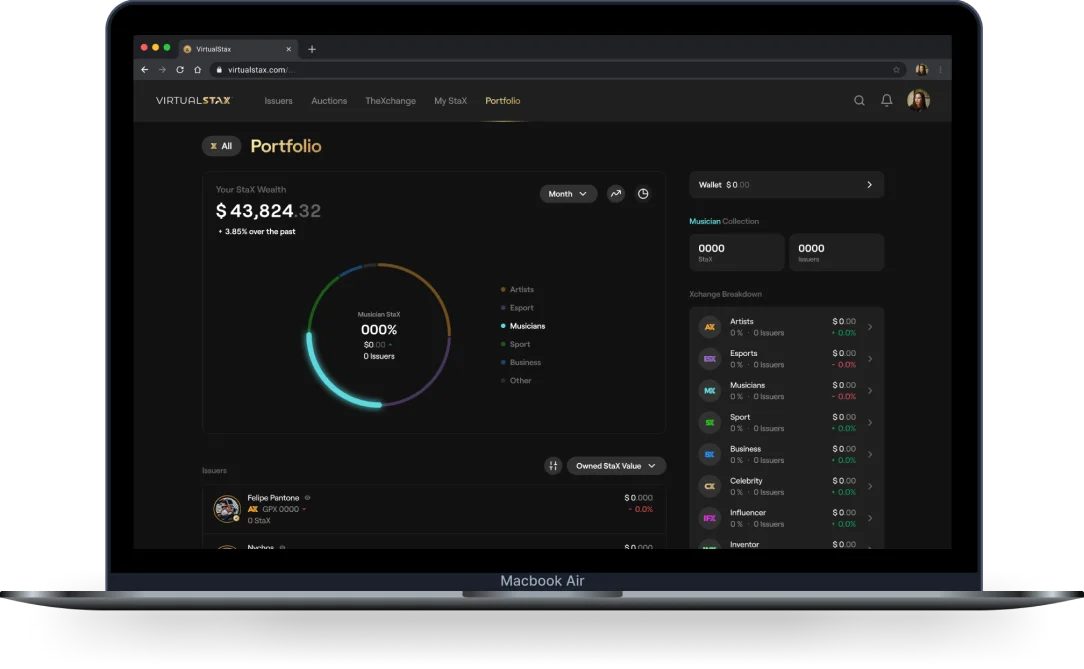

For the corporate sector, Startify-Loanato for Corporate offers unparalleled flexibility and support for a wide array of product types within a single loan request.

This module is adept at handling complex loan structures, including those combining various client sizes, and efficiently calculates repayment abilities, Debt Service Coverage Ratios (DSCR), and other relevant financial coefficients for all entities involved in the loan request. Its robust framework supports intricate financial arrangements, offering a tailored approach to each corporate client's unique needs.

Our platform integrates seamlessly across all stages of credit delivery, from initial customer interaction and offer generation based on verbal information to the intricate processes of application, analysis, risk assessment, and final disbursement.

Startify-Loanato supports the full credit lifecycle, including initial client contact, offer creation, application submission with complete documentation, and detailed processing across all relevant bank departments

Tailored to the needs of the RISK department, our module facilitates thorough risk opinions with features catering to small companies, the public sector, financial institutions, and large corporations, incorporating credit ratings, repayment capabilities, and collateral analysis.

Empower your institution with the ability to adjust decision-making matrices according to client exposure, credit rating, and internal competencies, ensuring a strategic and adaptable approach to credit approvals

Achieve unparalleled efficiency with a customizable workspace, real-time application dashboard, and streamlined document management, ensuring that every step is executed with precision and ease

Our platform supports applications through various channels, ensuring flexibility and accessibility for retail clients

With detailed logging of each action, Startify-Loanato enables the creation of insightful reports on processing times and helps identify bottlenecks, facilitating continuous process optimization

Startify-Loanato is designed to provide financial institutions with the tools they need to navigate the complexities of modern lending, ensuring both efficiency in process and accuracy in decision-making, tailored to the specific needs of corporate clients.