Loanato - Retail Module

Harun Grabus

Software Engineer Team Lead

7 min read

Published

27th July 2023

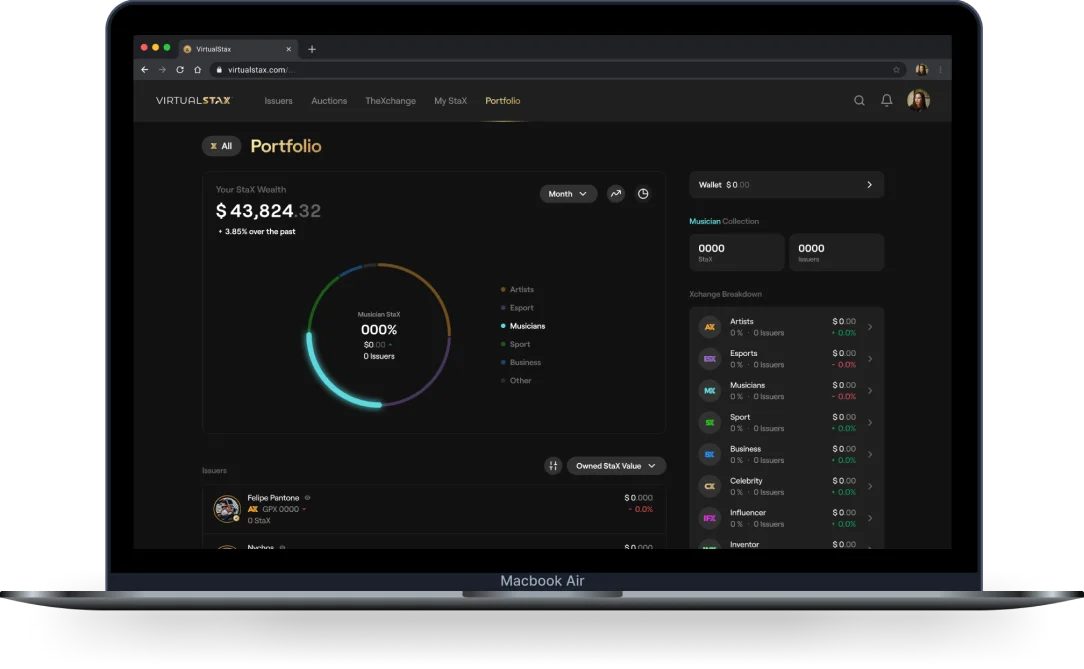

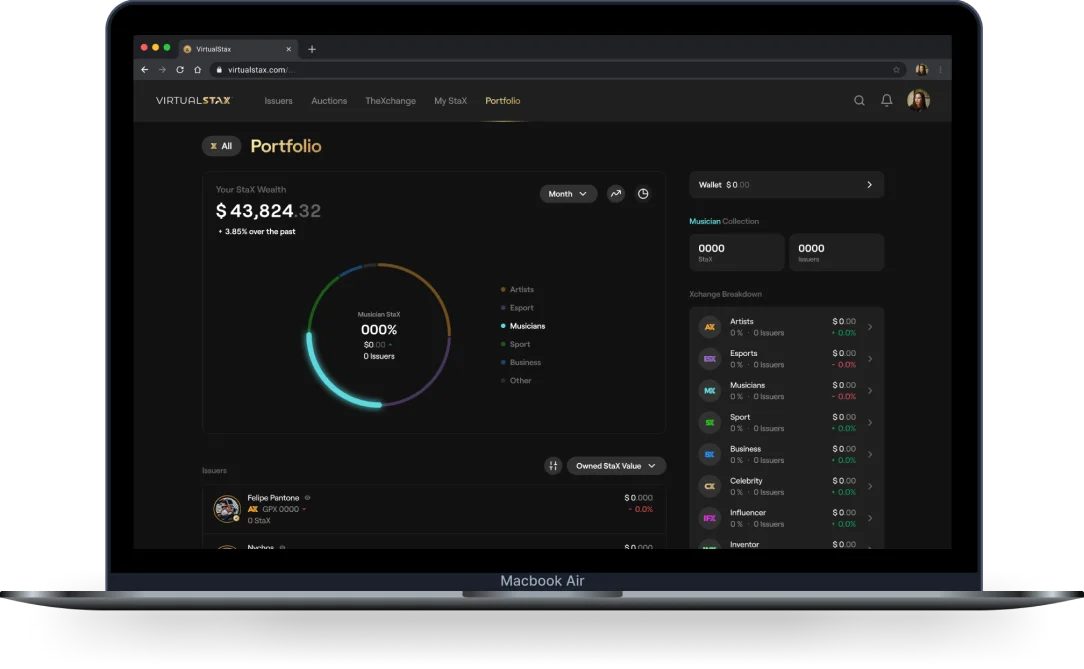

Startify-Loanato for Retail revolutionizes the retail banking sector by introducing a cutting-edge credit management solution designed to streamline and expedite the loan approval process. Our platform leverages sophisticated automated decisioning algorithms and an extensive decision-making matrix, enabling banks to offer rapid, accurate assessments of applicants' repayment abilities.

With extensible calculations and tailored decision proposals based on comprehensive financial data analysis, we ensure an efficient, customer-friendly borrowing experience. This module significantly speeds up the lending process, allowing banks to provide instant credit decisions, thus enhancing customer satisfaction and loyalty.

Our platform integrates seamlessly across all stages of credit delivery, from initial customer interaction and offer generation based on verbal information to the intricate processes of application, analysis, risk assessment, and final disbursement.

Startify-Loanato supports the full credit lifecycle, including initial client contact, offer creation, application submission with complete documentation, and detailed processing across all relevant bank departments

Tailored to the needs of the RISK department, our module facilitates thorough risk opinions with features catering to employed/unemployed/self-employed individuals and pensioners, incorporating credit ratings, repayment capabilities, and collateral analysis

Empower your institution with the ability to adjust decision-making matrices according to client exposure, credit rating, and internal competencies, ensuring a strategic and adaptable approach to credit approvals

Achieve unparalleled efficiency with a customizable workspace, real-time application dashboard, and streamlined document management, ensuring that every step is executed with precision and ease

Our platform supports applications through various channels, ensuring flexibility and accessibility for retail clients

With detailed logging of each action, Startify-Loanato enables the creation of insightful reports on processing times and helps identify bottlenecks, facilitating continuous process optimization

Startify-Loanato is not merely a software solution; it is a strategic asset for banks aiming to modernize and optimize their credit management practices, ensuring efficiency, risk mitigation, and superior customer service.